Owning a home is a dream for many Australians, but saving a big deposit can take years. Rising property prices and the cost of living often make the goal feel out of reach. The Home Guarantee Scheme was created to change that. It helps eligible buyers purchase a home with a smaller deposit, avoid expensive Lenders Mortgage Insurance (LMI), and step into the market sooner.

What is the Home Guarantee Scheme?

The Home Guarantee Scheme is an initiative by the Australian Government to support buyers who are ready to purchase but don’t have the 20% deposit most lenders require. Instead of waiting years to save, eligible buyers can purchase a property with as little as 5% deposit.

The government then guarantees up to 15% of the loan, which means you don’t need to pay LMI. This guarantee gives lenders confidence to approve your home loan without you having to save a large deposit.

Why the Home Guarantee Scheme Matters

Saving for a deposit has always been one of the biggest challenges for home buyers. With property values rising in many areas, saving 20% can feel impossible. For example, a $600,000 home usually requires a $120,000 deposit to avoid LMI. Under the Home Guarantee Scheme, you only need $30,000.

This difference is life-changing. It allows buyers to get into the market earlier, start building equity, and achieve stability for their family without waiting for years.

Different Guarantees Under the Scheme

The Home Guarantee Scheme has three main pathways designed to meet the needs of different buyers:

- First Home Guarantee (FHBG) – For first home buyers who can buy with as little as 5% deposit.

- Family Home Guarantee (FHG) – Specifically for eligible single parents with dependent children. They may buy with just a 2% deposit.

- Regional First Home Buyer Guarantee (RFHBG) – Designed for buyers in regional areas who only need a 5% deposit.

Each option aims to make buying a home more accessible, no matter your circumstances.

Eligibility for the Home Guarantee Scheme

- Applicants must be Australian citizens or permanent residents, aged 18 or over.

- For the First Home Guarantee (FHBG) and Regional First Home Buyer Guarantee (RFHBG), applicants must not have owned or held an interest in residential property (including strata or company title properties, whether lived in or not) within the past 10 years.

- Under the Family Home Guarantee (FHG), applicants may have previously or currently owned a home, but at the time of purchase must not hold a freehold interest in property (including land).

- Meet the income caps set by the government.

- For the FHBG and RFHBG, co-borrowers can include married or de facto partners, siblings, parent/child, or friends.

- For the FHG, applicants must be a single parent or single legal guardian with at least one dependent child.

- The scheme applies only to owner-occupied home loans on a principal-and-interest basis. Investment properties and interest-only loans are excluded.

- Loans for purchasing vacant land and building a home may be eligible, even if the construction loan allows interest-only repayments during the build period.

-

- FHBG and RFHBG: deposit must be between 5% and 20% of the property’s value.

- FHG: deposit must be between 2% and 20% of the property’s value.

Key Benefits of the Home Guarantee Scheme

Here’s why so many Australians are considering the Home Guarantee Scheme:

-

- Smaller Deposit Required – Buy a home with as little as 5% (or 2% for single parents).

- No LMI Costs – Save thousands of dollars by avoiding Lenders Mortgage Insurance.

- Government-Backed Confidence – The government guarantee gives lenders confidence to approve your home loan.

- Regional Support – The scheme encourages home ownership outside major cities with special guarantees for regional areas.

- Faster Entry Into the Market – Start building equity and security sooner rather than later.

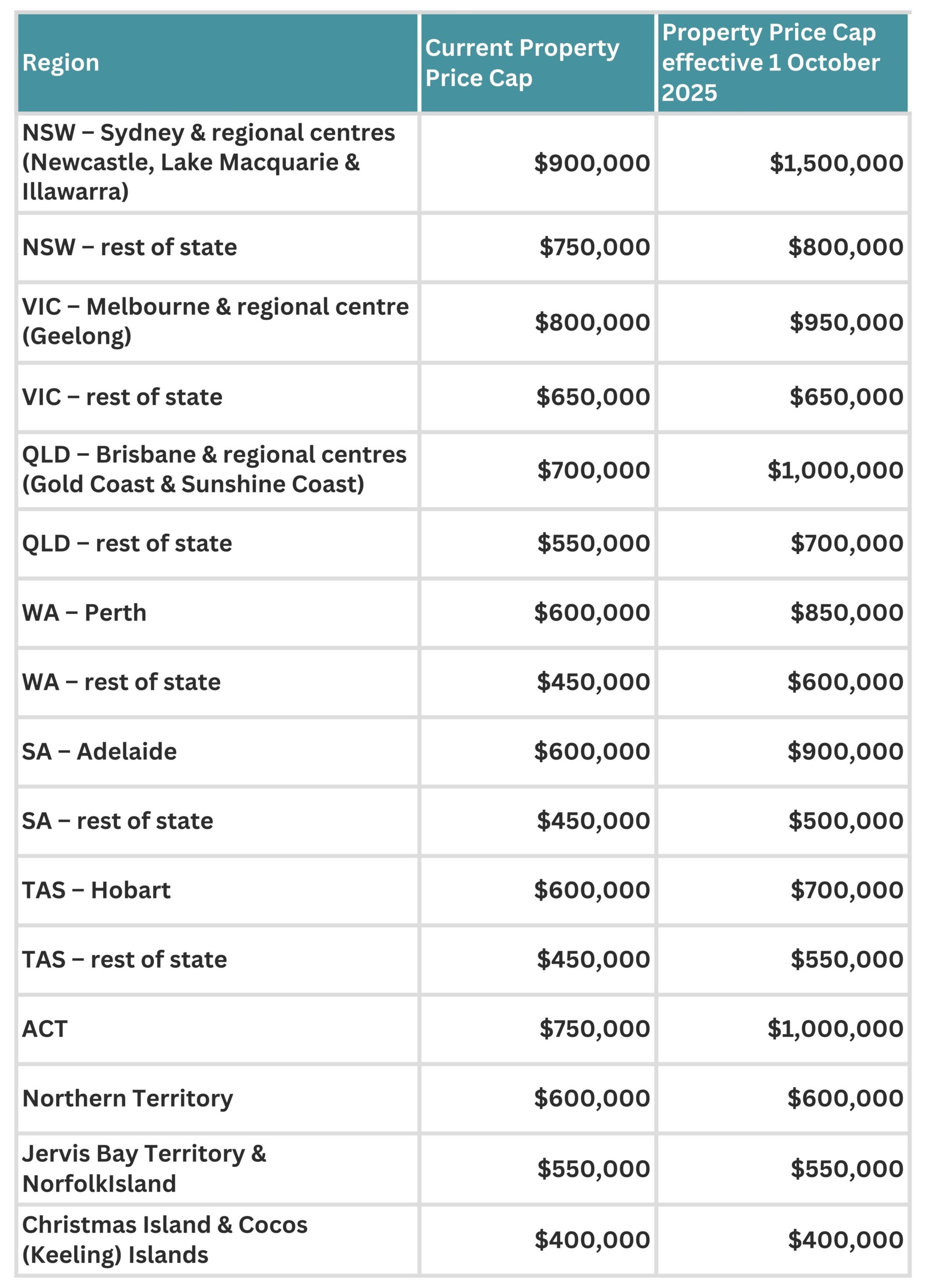

What Are The Price Caps For The First Home Guarantee?

How Philips Group Can Help

At Philips Group, we are an Australian Broker that specialises in guiding buyers through the Home Guarantee Scheme. Our role is to:

- Check your eligibility for the scheme.

- Compare loans from multiple lenders who participate in the program.

- Support you from application to settlement.

Buying a home is exciting, but it can also be overwhelming. Having a broker by your side means you don’t need to figure it all out on your own. We do the heavy lifting while you focus on choosing the right home for your family.

The Home Guarantee Scheme is one of the most effective ways Australians can achieve home ownership sooner. By reducing the deposit needed and removing the burden of LMI, it helps first home buyers, single parents, and regional buyers take that big step forward.

If you’re ready to explore your options, we are here to guide you. We will explain the process, connect you with the right lenders, and give you the confidence to make one of life’s biggest decisions.

Don’t wait years to save a 20% deposit—see if the Home Guarantee Scheme could open the door to your first home today.